Credit for personal loans by banks and NBFCs has almost tripled in the last six years to Rs 51.7 trillion, which constitutes 30.3 percent of the total loan book as of March 31, 2023, against Rs 18.6 trillion or 21.5% of the total loan portfolio. on March 31, 2017, according to a report from rating agency CareEdge.

Total credit market size for personal loans (credit from banks + NBFCs): CareEdge

The growth rate of personal loan portfolios (which generally amounts to consumer loans) is almost double that of the rest of banking sector lending (business loans).

During the financial years 2017 to 2023, personal loan credit grew almost one and a half times the overall credit growth across both banks and non-banking financial companies (NBFCs).

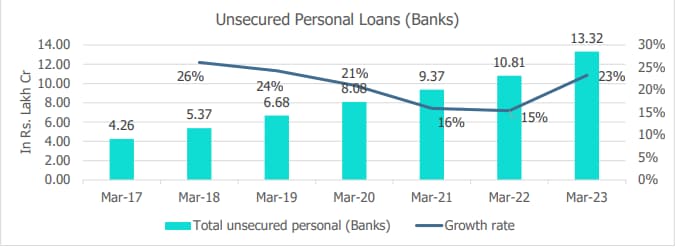

The growth of unsecured personal loans exceeds the total growth of private loans:

Within personal credit (which generally means consumer loans), unsecured personal loans exceeded the overall growth of the personal loan portfolio and constituted almost a third of the total personal loan segment loans of Rs 41 trillion as of March 31, 2023, CareEdge noted.

This trend is further fueled by the rise of Fintech and digital channels, which have contributed to increased production volumes.

Loans of less than Rs 1 lakh constitute 85% of loans in FY23

NBFCs’ emphasis on smaller, ticket-sized loans has been a key driver of volume growth in the unsecured personal loan segment. Loans with a ticket size of less than Rs 1 lakh constituted more than 85% of loans disbursed in FY23 by volume. Loans with ticket size below Rs. 50,000 hold the majority share of production volume, witnessing a more than doubled increase in production value in this segment compared to the last two budgets ending March 2023.

What led to this increase in demand for personal loans?

“Several factors have contributed to the substantial increase in demand for unsecured personal loans, including demographic shifts, the formalization of the economy, increased purchasing power, the evolution and prominence of FinTechs, widespread access to the internet/broadband and feature phones, the adoption of digital payment systems, the influence of the Indian stack and information material, and broader coverage of credit bureaus, etc.,” the CreditEdge report said.

The transformation in consumer behavior has emerged as a crucial driver behind the increase in demand for unsecured personal loans, especially within consumption-driven growth patterns.

In particular, there is a noticeable change in mindset among younger demographics, who are now embracing the idea of borrowing for consumption, which contrasts significantly with the perspectives of the past decade. “The significant evolution in lending processes, heavily influenced by digital infrastructure, has significantly increased flexibility and convenience for consumers, especially the younger target group. This evolution is a key enabler in the consumption-driven growth we see today,” the report said.

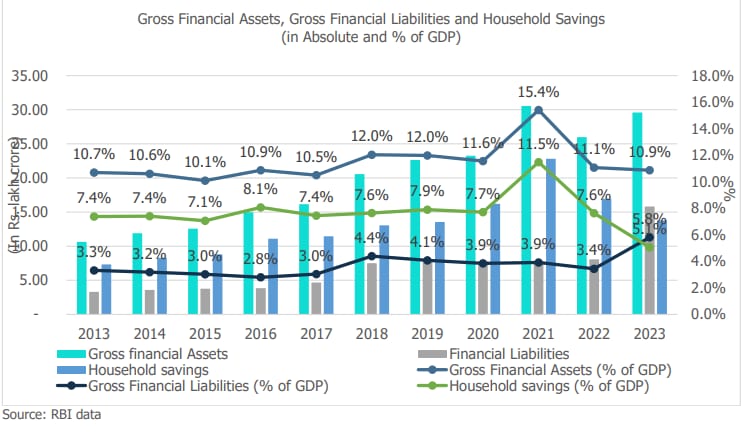

Consumption-driven growth caused household savings to fall to the lowest level in 47 years

However, this consumption-driven growth has also led to an increase in households’ total financial obligations. According to the latest report on household savings by RBI, household savings in India hit a 47-year low at 5.1% of GDP in FY23. This was mainly due to the increase in household financial obligations, indicating that people are becoming increasingly dependent on loans to meet their consumption needs.

Household savings in India as % of GDP

The decline in household savings was particularly visible after FY21, with pent-up demand post-coronavirus leading to higher consumption. Even more loans are said to have been taken out, probably due to the difficulties caused by rising inflation.

While high household indebtedness may not necessarily be a concern if there is sufficient income, an increasing share of borrowing by those with weak earning profiles could lead to loan repayment challenges in the unsecured retail loan segment, which has been identified by RBI highlighted as good,” the report said.

Impact of RBI’s latest move to deter personal loan growth

Strong signals from the Reserve Bank of India (RBI) could act as a deterrent to the growth of unsecured personal loans, potentially causing a partial slowdown in the near term. According to CareEdge, the impact on NBFCs is expected to be two-fold:

- The RBI’s directive to increase risk weights by 25% for advances to AAA-rated non-banking financial companies (NBFCs) is likely to prompt banks to adjust loan prices.

- Moreover, RBI has increased risk weights on NBFCs’ unsecured personal loans by 25%. This adjustment is expected to impact the capital buffers of NBFCs. There may therefore be a delay in lending.

“While asset quality has remained stable, there is a need for vigilant monitoring, especially on small size loans; furthermore, as each player focuses on specific sub-segments, this may lead to diverging credit cost trends in these players’ unsecured retail portfolio ” the report said.