- The ruling is one of the largest in American antitrust history, after twenty years of litigation

Visa and Mastercard have agreed to cap credit card fees paid by merchants in a landmark settlement that follows a two-decade legal battle.

Both companies will reduce the fees that businesses pay to accept credit card fees, also known as “swipe” or interchange fees.

The ruling is one of the largest in U.S. antitrust history and business owners say it could save them $30 billion over five years.

Robert Eisler, co-lead counsel for the plaintiffs, said in a statement: “This settlement achieves our goal of removing anti-competitive restrictions and providing immediate and meaningful savings to all American merchants, small and large.”

Under the settlement announced Tuesday, Visa and Mastercard will cap credit interchange fees through 2030, and the companies will have to negotiate the fees with merchant buying groups.

The deal must still be approved by the U.S. District Court for the Eastern District of New York.

Visa and Mastercard have agreed to reduce interchange fees on credit cards in a historic settlement that follows two decades of litigation

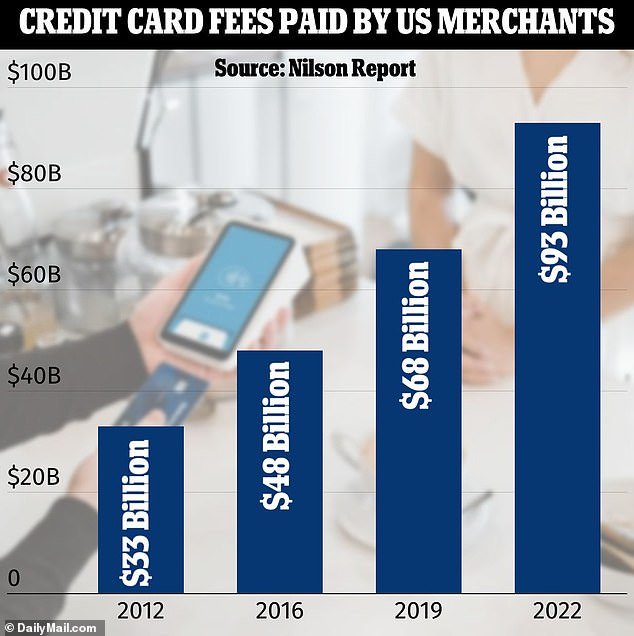

According to industry publication The Nilson Report, merchants paid an estimated $93 billion in Visa and Mastercard fees last year – up from about $33 billion in 2012

Retailers have long complained that the so-called “swipe fees” they have to pay to process credit card transactions in the US are much higher than anywhere else in the world.

The fee averages 2.24 percent of the total transaction in the US, but can be as high as 4 percent for premium travel and rewards cards. In the EU, fees were limited to 0.3 percent in 2015.

Industry publication The Nilson Report estimated that merchants paid $93 billion in Visa and Mastercard fees in 2022, up from about $33 billion in 2012.

The two credit card providers control about 83 percent of the U.S. market — meaning they have a monopoly on the swipe fees paid by retailers.

Danny Reynolds has run Stephenson’s of Elkhart, a clothing store in Elkhart, Indiana, for almost 30 years

Although Visa and Mastercard set the fees, it is the banks that issue the cards that generate the most revenue.

JPMorgan Chase, for example, collected $31 billion in exchange and trade processing revenue last year. After taking into account customer rewards, partner payments and other costs, this meant the bank generated a total of $4.8 billion in card revenue.

This is a current news story. Follow us for updates