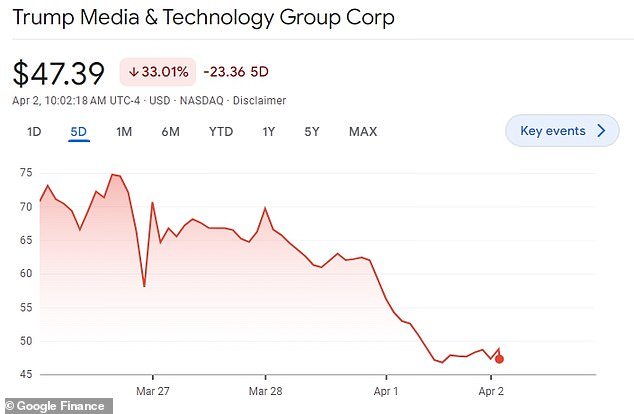

- The company’s shares settled at $59 before falling below $50 on Monday

- That resulted in a paper loss of $1 billion for the former president

- Critics call it a “meme” stock whose value dwarfs its gains

Donald Trump experienced a stunning $1 billion paper loss on his Trump media stock on Monday, after a filing showed it lost $58 million last year.

Shares in Trump Media were trading at $48 per share on Tuesday morning – down 32 percent from where they were five days ago.

It fell 21 percent in a single day of trading Monday, as investors digested new details of the company’s financials amid rumors that it is the latest “meme” stock to pique the market’s interest.

Trump still had a billion-dollar stake in the company. But at today’s prices, its value was still 1,500 times its sales, which were just $4 million last year.

The latest filing also included an auditor’s warning that the “operating losses cast substantial doubt on its ability to continue as a going concern.” CNBC reported.

Company CEO former Rep. Devin Nunes, who owns 115,000 shares in the company for a $5.6 million stake as of Tuesday morning, spoke about the company in a statement Monday.

‘We are pleased to be able to operate as a listed company and have secure access to the capital markets. Truth Social closes 2023 financials related to the merger and today has no debt and over $200 million in the bank, opening up countless opportunities to expand and improve our platform. We intend to take full advantage of these opportunities to make Truth Social the ultimate free speech platform for the American people.”

Former President Donald Trump’s stake in Trump Media is estimated at more than $4 billion. But he is not allowed to sell his shares within a six-month lock-up period

Trump’s media company lost $58 million last year, according to a new media report, as skeptics said the multibillion-dollar company had the hallmarks of a “meme” stock.

The company had revenues of $4.1 million in 2023, according to the new filing. That comes after Trump Media rocketed to an $8 billion valuation when it debuted on the NASDAQ, even as watchdog groups warned it was a meme stock that raised ethical concerns.

The company was valued at about $7.5 billion Monday morning following the report’s release, with share prices falling into the low 50s after peaking at nearly $75 last week.

The stock traded at nearly $60 per share on Monday after the Easter holiday before falling to a low of $53, down about 15 percent. It fell below $50 after midday trading and ended the day there.

That came after a weekend in which Trump posted more than 70 times on Truth Social, from a post wishing his political enemies a “Happy Easter” to those who attacked the judge in his New York fraud trial and the daughter of the judge who tried the was in charge of the Stormy Daniels case.

The company began trading under the ticker DJT — Trump’s initials — last week after merging with Digital World Acquisition Corp.

Trump Media stock has fallen about 32 percent over the past five days and was trading below $50 Tuesday morning

By contrast, Reddit, the tech company that went public days before Trump’s firm, had revenue of about $800 million.

Trump’s Truth Social platform drew 277,000 visitors on Tuesday when it debuted. It had about 5 million monthly users in February, up from about 2 billion for TikTok.

Trump owns about 57 percent of the company, although he is prohibited from selling shares for a period of six months unless the company’s board, full of Trump loyalists, votes to allow a sale.

Others who have entered into “lock-up” agreements include longtime Trump aide Dan Scavino, former Rep. Devin Nunes – the company’s CEO Donald Trump Jr., and former Pentagon aide Kash Patel.

Board members who could greenlight the sale include wrestling executive Linda McMahon, Patel and former U.S. Trade Representative Robert Lighthizer, though any move could expose them to lawsuits if they are found not to be acting in the best interests of shareholders.

Trump’s continued enormous efforts come as he faces continued financial pressure amid his four criminal cases. A New York appeals court reduced his verdict in his fraud trial to $175 and gave him 10 days to pay the amount pending his appeal or otherwise obtain bond. The deadline comes this week.