- Student borrowers who took out loans between 2013 and 2015 but dropped out collectively own $918 million more than they first took out years later

- Those who do not complete their studies take out smaller loans and tend to struggle to pay them off

- Biden has accelerated a new student loan forgiveness plan that will wipe out the debt of borrowers with smaller loans

Student loan debt for Americans who have dropped out of college has risen by $1 billion, new data shows, as millions hope to have their debt wiped out by a new Biden administration forgiveness program.

A new report from the Higher Education Advisory Group Borrowers who took out loans between 2013 and 2015 but never completed college collectively owe $918 million more than they borrowed in the first place four years later, in 2017 to 2019.

Those who took out loans and completed college in the same time frame owe $3.2 billion less than the amount they first borrowed.

The report, commissioned by the National Association of Student Financial Aid Administrators, used federal databases to analyze the debt of 3.9 million student loan borrowers from 1,949 higher education institutions.

“Completing college is critical to success. And if you complete your studies, you are more likely to be able to pay off your student loans, compared to those who attend college but never complete their degrees,” the report said.

Data shows that borrowers who took out a loan between 2013 and 2015 but never completed college collectively owe $918 million more than they borrowed in the first place four years later

“If these borrowers now owe more than they initially borrowed, it may indicate that they are not earning enough to keep up with the interest on their federal loans.”

The report also found that the type of institution, regardless of completion, can play a role in the amount of student loan debt owed.

According to the analysis, students who complete their programs at for-profit institutions owe $951 million more four years later, and those who do not complete their degrees owe $337 million more than they initially borrowed.

President Joe Biden is under pressure to cancel student loan debt after the Supreme Court rejected his plan to cancel $400 billion in debt.

Interest on federal student loans resumed in September and payments picked up again in October, after a three-year hiatus that began during the COVID-19 pandemic.

Two weeks ago, Biden accelerated a new student loan forgiveness plan that wipes out the debts of certain borrowers who have paid off over the past decade. The plan, which comes into effect in February, will apply to borrowers who have taken out a relatively large number of loans. small loans and are included in the Biden administration’s new income-driven payment plan.

“(Borrowers) who took out less than $12,000 in loans and have been in repayment for 10 years will have their remaining student debt immediately forgiven,” Biden said.

The plan was originally scheduled to start in July, but will come into effect six months earlier. applies to borrowers enrolled in the new income-driven repayment plan known as Saving on a Valuable Education Plan (SAVE).

President Joe Biden has accelerated a new student loan forgiveness plan that will wipe out some borrowers’ debts paid off over the past decade.

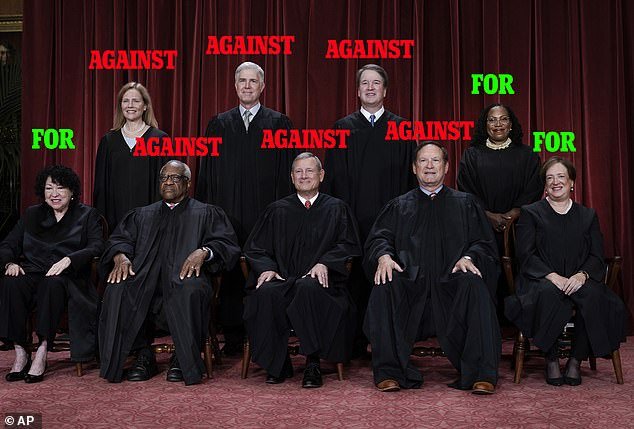

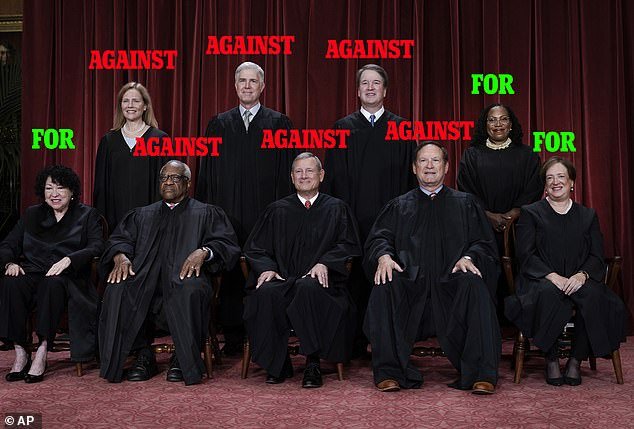

The Supreme Court rejected President Joe Biden’s $400 billion student loan forgiveness plan in June 2023. The justices ruled 6-3 against Biden’s plan

“This action will especially help community college borrowers, low-income borrowers and those struggling to repay their loans,” Biden said.

“It’s part of our ongoing efforts to act as quickly as possible to give more borrowers breathing room so they can escape the burden of student loan debt, move on with their lives and pursue their dreams.”

The SAVE plan offers much more generous terms than several other income-driven repayment plans it is designed to replace. Previous plans offered cancellation after 20 or 25 years of payments, while the new plan offers this in just 10 years. The new plan also lowers monthly payments for millions of borrowers.

According to the White House, 30 million people are eligible for the SAVE plan, with 6.9 million currently enrolled.

Counterintuitively, people with smaller student loan balances often have a harder time. It’s caused by millions of Americans taking out student loans but not completing their studies, leaving them with the downside of debt without the downside of higher income.