HONG KONG — Asian markets were mostly higher on Wednesday ahead of expected guidance from the Federal Reserve on the timing of rate cuts.

Oil prices and US futures fell.

The Japanese markets were closed for a holiday. On Tuesday, the Bank of Japan raised its key interest rate for the first time in seventeen years, from minus 0.1% to a range of zero to 0.1%.

The US dollar rose against the Japanese yen after the BOJ’s comments on its decision showed that a wide spread between interest rates in the United States and Japan will remain for the foreseeable future. The dollar rose to 151.46 yen from 150.87 yen, trading at its highest level in four months.

Hong Kong’s Hang Seng rose 0.3% to 16,580.95, and the Shanghai Composite index rose 0.5% to 3,077.99.

China left key interest rates unchanged on Wednesday, as expected. Although the economy shows signs of improvement, the real estate market remains precarious.

Elsewhere, the Australian S&The P/ASX 200 fell 0.1% to 7,695.80, while South Korea’s Kospi rose 1.3% to 2,690.48, while Taiwan’s Taiex lost 0.4%.

On Tuesday the S&The P500 rose 0.6% to 5,178.51, surpassing last week’s all-time high. The Dow Jones Industrial Average rose 0.8% to 39,110.76, and the Nasdaq composite gained 0.4% to 16,166.79.

International Paper rose 11%, making it the biggest gainer in the S&P500 was named for Andrew Silvernail, an executive at investment firm KKR, as its new CEO.

Shares of Unilever trading in the United States added 2.8% after it said it would spin off Ben & Jerry’s and its ice cream company, while cutting 7,500 jobs.

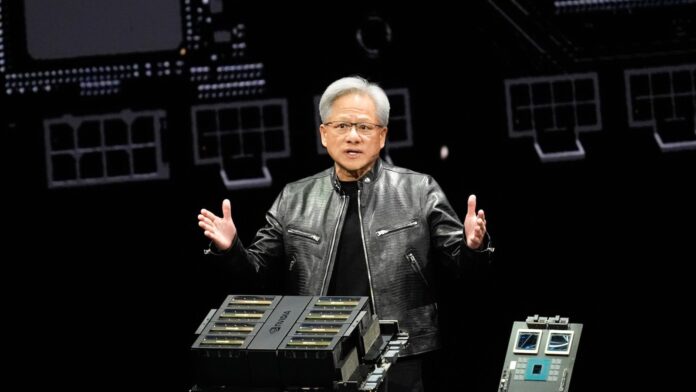

Nvidia went from a loss of almost 4% to a gain of 1.1%.

On Wall Street’s losing side was Super Micro Computer, whose shares had previously risen from less than $100 to more than $1,000 in a year. The seller of server and storage systems used in AI and other computer systems fell 9% after saying it planned to sell 2 million shares of its stock.

Elsewhere on Wall Street, the focus was on the Federal Reserve.

The Fed started its latest interest rate meeting on Tuesday and will announce its decision later in the day. There is widespread expectation that the key interest rate will remain unchanged at a 20-year high. The hope is that the country will signal that it still expects to cut rates three times later this year, as it hinted a few months ago.

Part of the push to send U.S. stocks soaring to records is due to hopes for such cuts, which would ease pressure on the economy and financial system. But recent inflation reports have consistently come out worse than expected. That could force the Fed to say it will make fewer rate cuts this year, and traders have already abandoned previous expectations that the first cut of the year would come on Wednesday.

Bank of America strategists expect Fed officials to stick with forecasts showing the mid-tier still expecting three cuts in 2024. But it’s close, and “risks are shifting to less signaled cuts,” said the strategists led by Mark Cabana.

In other trading, U.S. benchmark crude lost 28 cents to $82.45 a barrel in electronic trading on the New York Mercantile Exchange. Brent crude, the international standard, lost 20 cents to $87.18 a barrel.

The euro cost $1.0869, up from $1.0865.