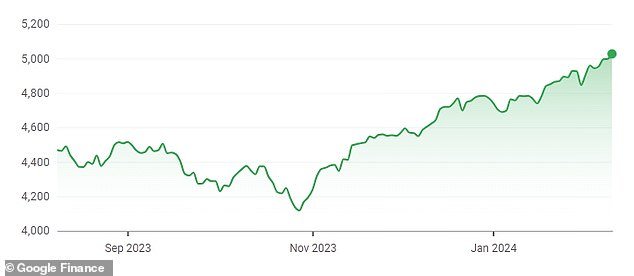

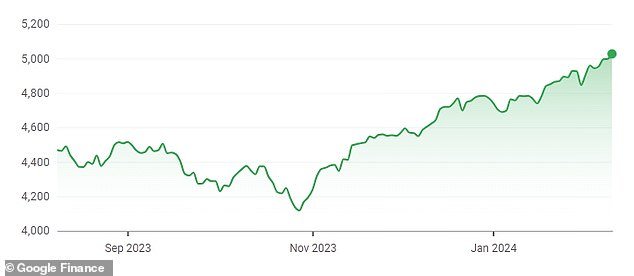

- The S&P 500 Index ended above 5,000 for the first time on Friday

- Investors trust artificial intelligence that interest rate hikes by the Fed are on the way

The S&P 500 closed above 5,000 for the first time Friday afternoon as technology stocks rallied and expectations increased that the Federal Reserve would finally cut rates.

The famous index tracks the performance of the 500 largest publicly traded companies in the US and is indicative of the perceived health of the economy.

Companies leading the charge are mainly tech giants that have been propelled by the artificial intelligence hype over the past year, many of which announced strong last-quarter results this week.

Chipmaker Nvidia gained ground on Friday after reporting it was building a new business unit focused on designing custom AI chips for cloud computing companies.

The S&P 500 closed above 5,000 points for the first time on Friday afternoon

Chipmaker Nvidia is a technology stock that has taken the lead in the S&P 500 thanks to the AI hype

The sustained rally that took the S&P to the 5,000 level began in late October. Pictured is the S&P 500 Index for the past five months

Adding to confidence that further economic growth is ahead is also the expectation that the Fed will soon cut record high interest rates.

Doing so will reduce the high borrowing costs that both businesses and consumers currently face and increase the amount of cash circulating in the economy.

And while the fact that the index surpasses the milestone level is fundamentally good news for American companies, it will also benefit millions of everyday Americans.

“It translates into gains in investment accounts, especially index-tracking mutual funds and ETFs, boosting retirement savings,” said Mark Hamrick, senior economic analyst at Bankrate.

“This record rally has been fueled by enthusiasm for big tech names, based on hopes for artificial intelligence amid the resilience of the US economy that supports corporate profits,” he added.