FTX employees wrote “oops” on a spreadsheet that showed it owed $20 billion five months before it collapsed.

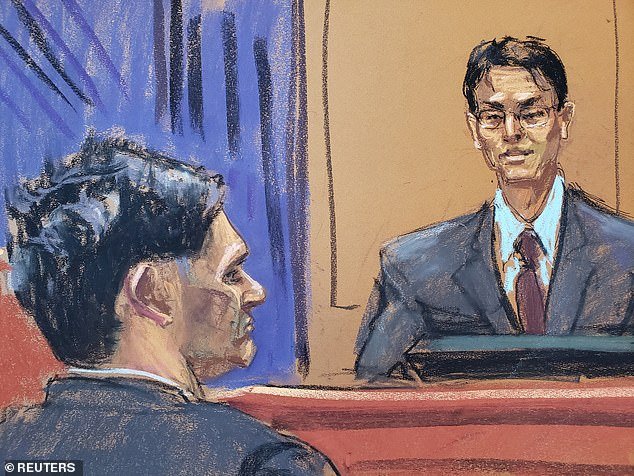

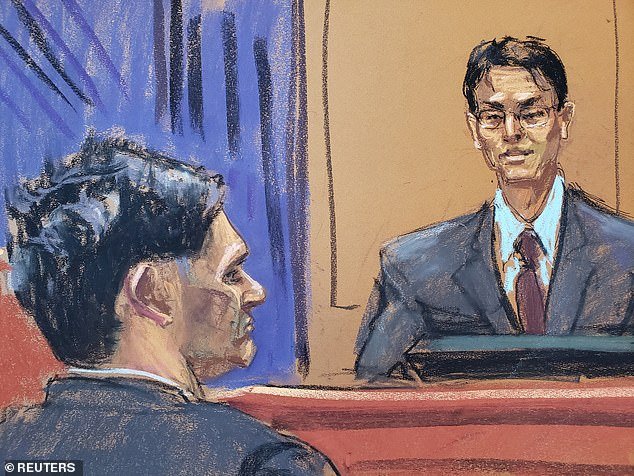

A New York court heard that Sam Bankman-Fried, the boss of the failed crypto exchange, ordered his staff to draft the document in July 2022 as investors demanded their money back.

Cryptocurrency prices had fallen and the industry was spooked, so Bankman-Fried wanted a full accounting of FTX’s debt.

Next to an entry for “expenses” that amounted to -$172 million, one of the senior staffers wrote, “Oops, does this sound like something we shouldn’t count?”

The spreadsheet emerged during the testimony of FTX co-founder Gary Wang, 31, one of the prosecution’s star witnesses, who claims Bankman-Fried defrauded customers of $10 billion

FTX co-founder Gary Wang took the stand Friday at the trial of Sam Bankman-Fried, claiming the company had been stealing customers’ money for three years

Wang claimed that Bankman-Fried ordered a $700 million loss to be posted to its sister company’s accounts because they were more secretive than FTX.

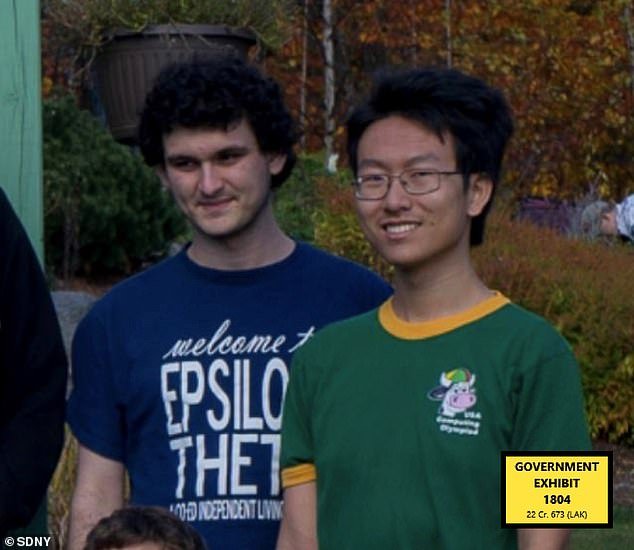

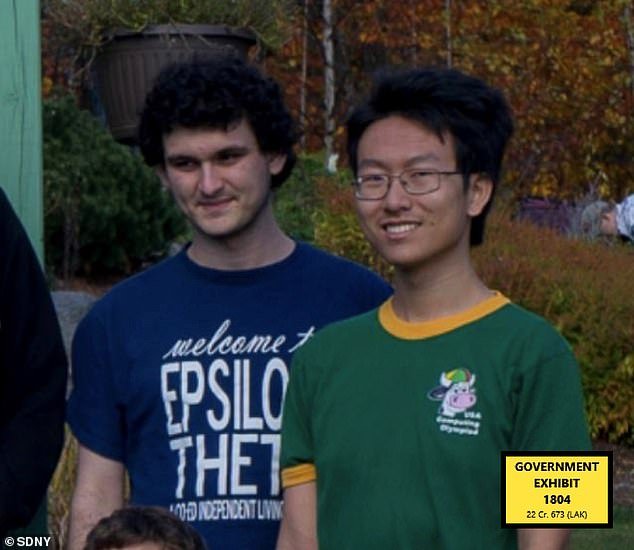

They were roommates at MIT, Wang told the court, but he has now turned against his former friend Bankman-Fried

Prosecutors allege the company was a “house of cards” that was worth $32 billion at its peak but collapsed last November after media reports raised questions about its finances.

Wang has pleaded guilty to bank fraud, commission fraud and securities fraud and is testifying as part of his plea deal.

Wang told the jury that FTX stole his customers’ money for three years before going bankrupt.

He said Alameda’s debt to FTX rose from less than $100 million in 2019 to $8 billion in November 2022, when it collapsed.

Gary Wang, who has pleaded guilty to his part in the scheme, agreed when prosecutors asked him if he had “committed financial crimes” while working at FTX, where he was chief technical officer.

Bankman-Fried approved a $65 billion line of credit for Alameda at FTX, meaning it had “virtually no limit” on how much it could borrow.

No other FTX customer had anything like this, Wang told the court.

He said he started noticing Alameda had a negative account balance in 2019 and asked Bankman-Fried about it.

Bankman-Fried said as long as the balance was less than FTX’s trading income, it was fine.

Wang told the court that FTX’s trading revenues at the time were $50-$100 million, a range within which Alameda’s debts fell.

But in late 2019 or early 2020, Wang discovered that Alameda’s debt exceeded FTX’s trading revenue.

Roos asked: ‘What were the implications of Alameda Research having a negative balance above FTX’s income?’

Wang said, “It meant that Alameda was taking customers’ money.”

When Wang spoke to Bankman-Fried about this, he was told to include the value of the FTT in his calculations, the court heard.

FTT was a cryptocurrency worth a few dollars each that FTX created itself, but Wang said this was problematic.

If all the FTT were sold, its price would fall, meaning there “may not be enough” to cover Alameda Research’s debt, Wang said.

When this secret became public in media reports in November 2022, it caused customers to rush to withdraw their funds, leading to the collapse of FTX.

But Wang said at the time that he did not question it further because he “trusted his (Bankman-Fried’s) judgment.”

At the end of 2021, Alameda’s debt stood at $3 billion, the court heard.

At one point, Wang noted that Alameda’s debt to FTX exceeded the combined value of FTX trading revenue and the value of FTT.

Roos asked: ‘Where did that money come from in that situation?’

Wang said, “From customers.”

Roos asked: ‘Did you think FTX or Alameda Research were allowed to use or spend customer money?’

Wang replied, “No. The money belonged to customers and customers did not give us permission.”

Despite this, Bankman-Fried publicly reassured his customers that everything was fine.

Wang, one of the prosecution’s key witnesses, said he committed the crimes together with Bankman-Fried, Caroline Ellison and Nishad Singh. Both have admitted their part in the scheme and are expected to testify at trial

Bankman-Fried, with Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang, to their left, at Bankman-Fried’s birthday in Hong Kong. The group dressed up in wigs that resembled Bankman-Fried’s hairstyle

On July 31, 2019, the same day he asked if Alameda could have a negative balance that would essentially allow it to borrow an unlimited amount, he tweeted that everything was fine.

On Twitter, a user asked Bankman-Fried about the “conflict of interest” as head of FTX and Alameda.

Bankman-Fried responded that Alameda’s account at FTX is “just like everyone else’s.”

Wang told the court this was not true.

Wang said that in 2019, Bankman-Fried instructed him to give special privileges to Alameda Research, FTX’s sister company that had just been founded.

Bankman-Fried owned both companies and served as Alameda’s CEO until 2021.

Wang said the special privileges for Alameda include the ability to have a negative balance — the company could owe as much as $65 billion — and make “unlimited withdrawals” from FTX.

Wang said that even if Alameda had no money in its account, it could still accept money from FTX.

Assistant U.S. Attorney Nicolas Roos asked, “When Alameda Research withdrew money below the zero balance, whose money did it withdraw?”

Wang said, “Money from FTX customers.”

Roos asked whether FTX disclosed Alameda’s special privileges to its investors or customers

Wang said no.

FTX founder Sam Bankman-Fried faces 115 years behind bars if convicted

According to Wang, the unusual arrangement was set up by Bankman-Fried to pay for “certain expenses” of Alameda Research.

No other account on FTX was allowed to have a negative balance, Wang told the court.

Bankman-Fried ordered a $700 million loss to be placed on its sister company’s accounts because they were more secretive than FTX.

Wang told the court that, confronted with the enormous sum, Bankman-Fried “told me to let Alameda take it over.”

Bankman-Fried told Wang the reason was because “FTX’s balance sheets are more public than Alameda’s balance sheets”

According to Wang, Bankman-Fried told him that investors could see FTX’s balances, but not Alameda’s.

Bankman-Fried has denied 13 charges between 2019 and 2011, including bank fraud, money laundering and violations of campaign finance laws, which could land him in prison for up to 115 years.

Seven of them will be treated during this process, the rest next year.

Caroline Ellison and Nishad Singh are also expected to testify at the trial.

Ellison used to run Alameda and was Bankman-Fried’s former girlfriend, while Singh was a top engineer at FTX.

Both have admitted their part in the scheme.

Wang said Bankman-Fried suggested the idea of closing Alameda in September 2022.

He said a Bloomberg article came out saying that FTX and Alameda were much closer than he had publicly stated.

Wang told the court that Bankman-Fried said it would be “bad for FTX” and that people would trust the company less.

Bankman-Fried prepared a Google Doc detailing the arguments for closing Alameda and showed it to the jury.

It said the “PR hit from FTX and Alameda was very big.”

The document also blamed Ellison, who was in charge of Alameda and had previously had a relationship with Bankman-Fried, saying that “the current leadership is not good enough.”

The filing also stated that her decision not to disclose an investment as a hedge was “critical” in putting them in the position they now found themselves in.

At a subsequent meeting, Ellison said Alameda owed FTX $14 billion, Wang told the court.

Wang said that in 2019, Bankman-Fried instructed him to give special privileges to Alameda Research, FTX’s sister company that had just been founded.

On November 6, 2022, customers began withdrawing funds at a rapid pace due to more damaging reports about FTX’s finances.

But when Wang went to check the company’s balances, he was surprised to see that they were the same as what customers had in their wallets.

Wang said he didn’t understand because he knew Alameda had borrowed heavily from FTX.

Wang told the court that Bankman-Fried “asked me if I included the special Korean accounts.”

Wang said, “He said, are you bringing our Korean friend? I didn’t know what he was talking about. Nishad sent me an account ID and said this was the account the balances were on.”

The jury heard that Wang was given the customer ID, which was listed under the email account [email protected]. He had never heard of it.

Wang said the account was changed from an Alameda subaccount to this other user “so that its balances would not be included in the line of credit for interest payments that Alamada paid.”

‘Oops’: What FTX staff wrote on spreadsheet showing $20billion in losses as co-founder Gary Wang testifies at Sam Bankman-Fried trial the company had been stealing its customers’ money for three years before it collapsed