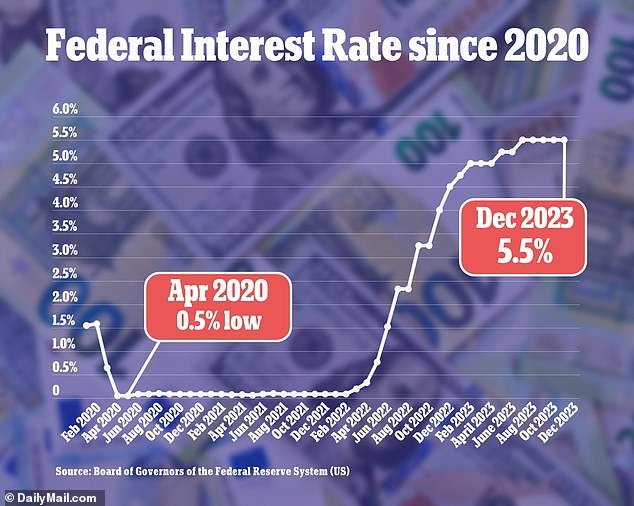

- The Fed expected to keep interest rates at current levels of 5.25 and 5.5 percent

- The yield on US government bonds fell to below 4 percent ahead of the news this morning

- Officials are cautious about cutting rates as long as the U.S. economy remains strong

The Federal Reserve is expected to keep interest rates steady for a fourth straight meeting today after borrowing costs rose to a 22-year high.

But there is now a 65 percent chance of a rate cut in March – thanks to promising economic data, according to interest rate traders.

Officials will announce their decision at 2 p.m. Economists predict there is little chance of a cut this month, meaning interest rates will remain at their current level of between 5.25 and 5.5 percent.

After today’s meeting, investors hope to get more clues at a press conference about when the Fed will cut rates.

But – even before that – the likelihood that the Fed will cut rates in March has increased today due to falling US Treasury yields.

The Federal Reserve is expected to keep interest rates steady for a fourth straight meeting today after borrowing costs rose to a 22-year high. Pictured: Fed Chairman Jerome Powell at the December meeting

Officials will announce their decision at 2 p.m., but economists predict there is little chance of a cut – meaning interest rates will remain at current levels between 5.25 and 5.5 percent.

According to CME FedWatch Tool, there is now a 64.8 percent chance. That’s an increase from 40.4 percent on Tuesday.

U.S. Treasury yields – an indicator of the interest rates charged by lenders around the world – fell below 4 percent on Wednesday morning.

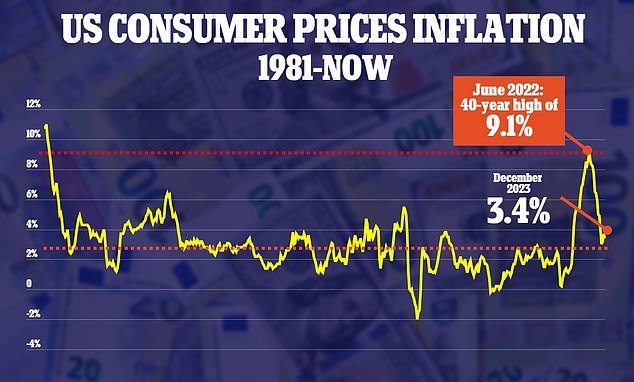

The Fed’s aggressive rate hikes were intended to pour cold water on raging inflation, which peaked at 9.1 percent in June 2022. Annual inflation hovered at 3.4 percent in December.

But rates remain well above the Fed’s 2 percent target, meaning a rate cut seems unlikely today.

Seth Carpenter, chief economist at Morgan Stanley, said Bloomberg: ‘You cannot deny that inflation has fallen significantly, and I don’t think they want that.

“On the other hand, I don’t think there will be a big banner that says ‘Mission Accomplished.’

The Fed’s fund rate determines the interest rate that banks pay when they lend to each other overnight. It has a knock-on effect on the rates companies charge customers for mortgages and credit cards.

Since rates started rising, mortgage rates peaked at nearly 8 percent before cooling off to around 6.6 percent.

“Powell will be walking a tightrope on policy from here, because the American economy is as good as it gets, and frankly at this point they’re trying not to screw it up,” Matt Miskin said. co-chief investment strategist for John Hancock Investment Management in Boston.

“It’s a balancing act for the Fed where you don’t want the economy to be so strong that inflation reaccelerates or returns,” he said. “But you also have to keep in mind that if inflation gets close to your target, you don’t have to be too restrictive.”

The Fed’s aggressive rate hikes were intended to pour cold water on raging inflation, which peaked at 9.1 percent in June 2022. Annual inflation hovered at 3.4 percent in December.

Economists generally believe the Fed is unlikely to cut rates as consumer spending has remained surprisingly resilient in the face of higher borrowing costs.

The U.S. economy grew 3.1 percent last year, faster than the average in the five years before the pandemic and compared with less than 1 percent in 2022.

This resilience is fueled by a red-hot labor market that has kept unemployment low.

U.S. private payroll companies added 107,000 jobs last month, according to figures from the ADP National Employment Report released today.

A key concern is that the Fed will cut rates too quickly, causing inflation to rise again.

Raphael Bostic, president of the Federal Reserve Bank of Atlanta, said on January 18: “Premature rate cuts could trigger a surge in demand that could put upward pressure on prices.”