How much do you REALLY need to retire? Fascinating map shows the income needed for senior citizens to live comfortably in each state

- Retirement will cost more than twice the amount in Hawaii than Mississippi

- The average annual cost of retirement in all 50 states is $68,000

- Assuming 3 percent inflation, retirees would need $3.5 million

Senior citizens looking to relocate may want to stay away from Hawaii, as it is the most expensive state to retire to, figures show.

Retirees in the Aloha State need $121,000 to live comfortably, according to study by GoBankingRates — compared to those in Mississippi who need just $55,000.

Washington DC, Massachusetts, California and New York were the next most expensive states to retire to, with an average annual cost of $94,000 across all four.

After Mississippi, the four cheapest states were Oklahoma, Alabama, Kansas and Iowa, with an average cost of $57,000 per year.

Across the US, the average annual income needed for comfort was $68,000.

In the 50 US states, the average annual income needed for comfort was $68,000, according to a study by GOBankingRates

Your browser does not support iframes.

Assuming an average inflation rate of 3 percent and that the American now retires at age 65, and is likely to live another 30 years, they will need nearly $3.5 million. These figures do not take into account the added bonus of Social Security payments.

The study considered the costs of groceries, health care, housing, utilities and transportation to determine the average retirement income that would be needed to enjoy a comfortable retirement.

After calculating total consumption expenditures, an additional savings buffer was calculated assuming that total expenditures consume 80 percent of a budget with 20 percent remaining for savings.

The GOBankingRates study analyzed the spending of Americans age 65 and older based on data from the most recent survey by the Bureau of Labor Statistics.

Expenditure estimates were then adjusted for each state by scaling each cost category by its corresponding cost of living index score.

In Hawaii, the most expensive state to retire, the study found that about $121,000 would be needed annually for a comfortable requirement. Pictured is an aerial view of Honolulu, Hawaii

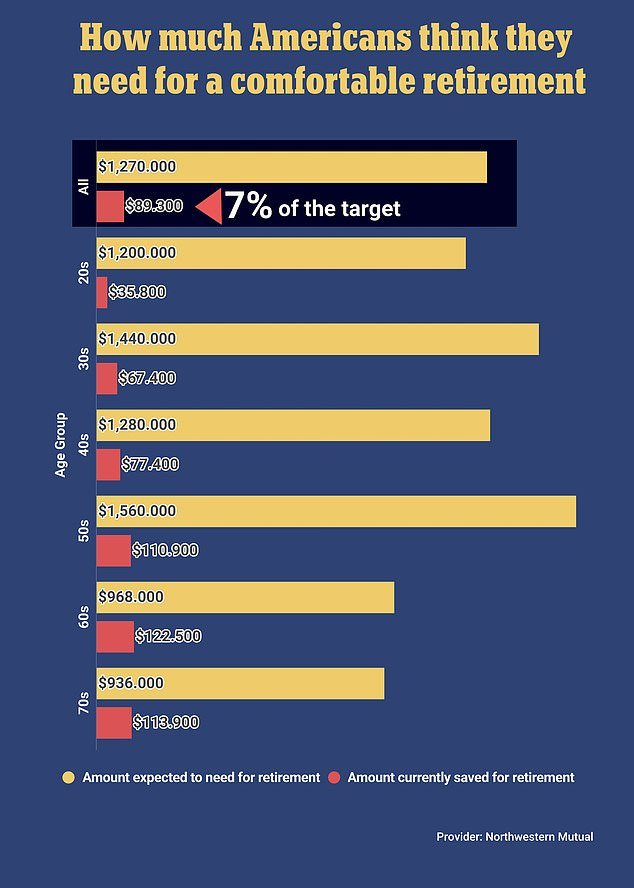

According to a recent Northwestern Mutual study, the average American predicts they will need $1.27 million to retire comfortably

Other studies have found that while many Americans recognize the need for such large sums to maximize their chances of a comfortable retirement, many simply do not have it.

According to a recent Northwestern Mutual study, the amount Americans predict they will need to retire comfortably is $1.27 million, but the average amount saved is just $89,300 — a mere 7 percent of the target amount.

However, almost half of those surveyed – around 48 percent – confessed that they did not think they would have enough money saved for the future they want, according to the findings.

Overall, the average American now thinks they will have to work until they are 65 to be ready for retirement, up from 64 last year.