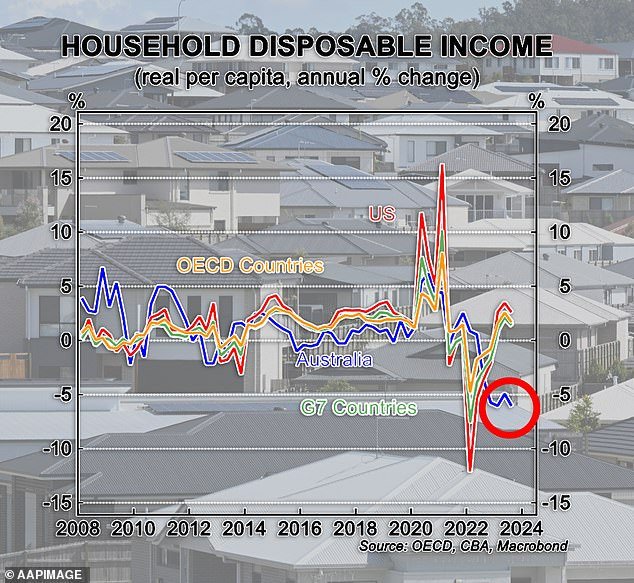

An economist’s surprising graph shows Australians are now a lot worse off than most of the developed world as a result of aggressive interest rate hikes.

Gareth Aird, head of Australian economics at the Commonwealth Bank, produced the chart and noted that Australian households typically saw their disposable income, after tax, fall by more than 5 percent.

The opposite happened in the United States and most rich countries of the Organization for Economic Co-operation and Development (OECD) and the G7.

“Real disposable income per capita has shrunk sharply in Australia due to negative real wage growth, rising housing interest rates and taxes paid,” Aird said.

“In contrast, real disposable household income per person has increased in most OECD countries over the past year, especially in the US.”

A Commonwealth Bank economist has created a graph showing Australians are much worse off than most of the developed world as a result of aggressive interest rate hikes

Gareth Aird, head of Australian economics at CBA, noted that Australian households typically saw their disposable income, after tax, fall by more than 5 percent.

Unlike the US and most of the developed world, almost all Australian borrowers now have variable mortgage rates, meaning any increase in the Reserve Bank’s cash rate is automatically passed on through higher monthly repayments.

The situation is very different in the United States, where almost all borrowers lock in their interest rates for 30 years, thanks to government-sponsored mortgage financing companies Fannie Mae and Freddie Mac.

But in Australia, monthly mortgage repayments have risen 67.7 per cent since May 2022, while the Commonwealth Bank’s variable rate rose to 6.69 per cent, up from 2.29 per cent for borrowers with a 20 per cent deposit.

This has resulted in borrowers with an average mortgage of $600,000 paying $18,744 more per year in repayments, while their monthly burden increased from $2,306 to $3,868.

The jump came as the Reserve Bank raised rates 13 times in 18 months, taking the cash rate to a 12-year high of 4.35 percent in November after the most aggressive series of rate hikes since 1989.

Mr Aird this week warned of another potential rate hike in 2024 before Australians can expect rate cuts, with underlying inflation rates north of 4 per cent – or well above the RBA’s target of 2 to 3 per cent.

This would add another $100 a month to repayments on a $600,000 mortgage, while the RBA cash rate rose to 4.6 percent – a level not seen since 2008.

“The near-term risk is related to a rate hike,” he said.

The situation is so bad that one in five borrowers now wants to buy somewhere cheaper, while 6 percent want to move abroad, a survey of 2,554 Australians by financial comparison group Mozo found.

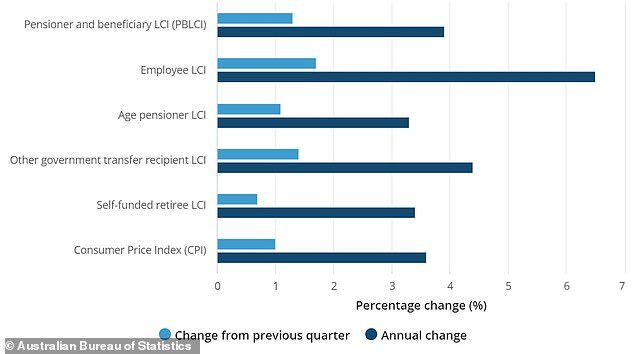

While headline inflation rose 3.6 per cent in the year to March, the cost of living for workers rose 6.5 per cent due to the big increase in mortgage repayments, new data from the Australian Bureau of Investigation shows the Statistics released on Wednesday.

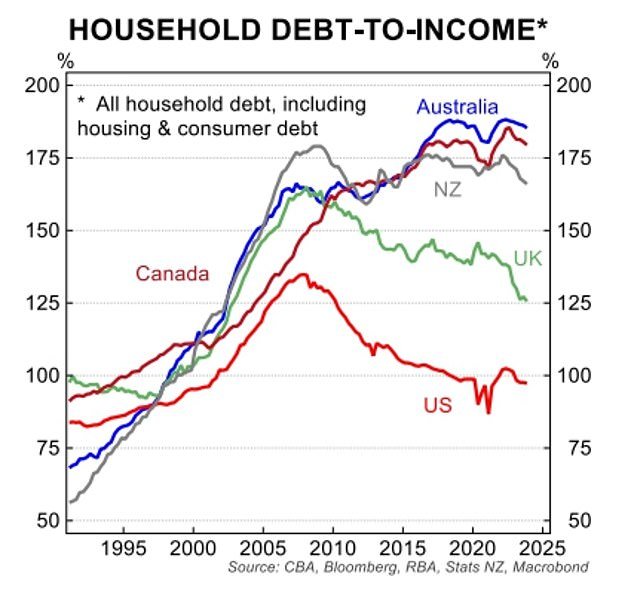

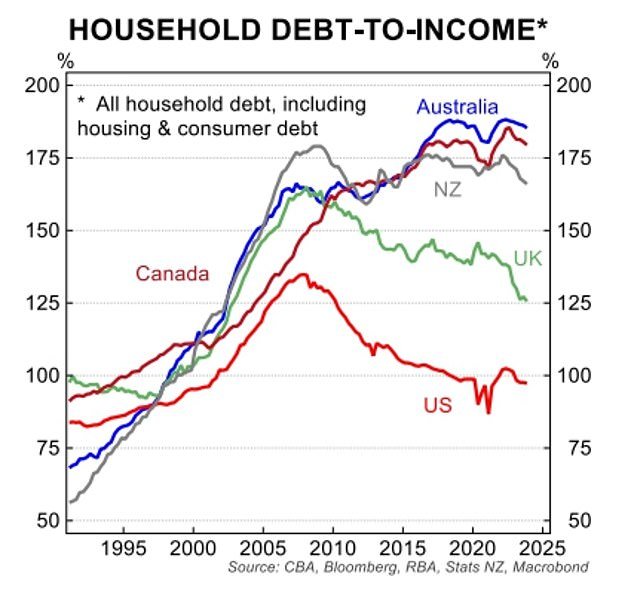

The Commonwealth Bank also noted that the 185 percent ratio of Australian household debt to income was among the highest in the world, as house prices rise by double digits over the year – or at a level more than is double that of wages.

While headline inflation rose 3.6 per cent in the year to March, the cost of living for workers rose 6.5 per cent due to the big increase in mortgage repayments, new data from the Australian Bureau of Investigation shows the Statistics released on Wednesday.

“Australian households are among the most indebted countries in the world,” Aird said.

‘This makes them more exposed to interest rate increases than households in most other jurisdictions.

“Put another way, high levels of household debt to income are amplifying the already stronger transmission of upward movements in cash rates to home loans.”

Australian workers also faced a reduction in real wages from early 2021 to the end of last year as their wage increases lagged behind inflation.

The end of low and middle income tax compensation in June 2022 also meant Australians had the fourth highest income tax burden of the OECD’s 38 member states.

Australia’s level of 24.9 percent was only surpassed by Denmark (36 percent), Iceland (27.3 percent) and Belgium (26 percent).

Daniel Wild, deputy director of the Institute of Public Affairs think tank, said Australia’s higher taxes were a threat to economic freedom.

“The more the government takes what workers earn, the less freedom they have to make a living and do things for themselves,” he told Daily Mail Australia.

Daniel Wild, the deputy director of the Institute of Public Affairs think tank, said Australia’s higher taxes threaten economic freedom

The Commonwealth Bank also noted that the 185 percent ratio of Australian household debt to income was among the highest in the world, as house prices rise by double digits over the year – or at a level more than is double that of wages.

“The OECD figures show that Australian workers are among the worst affected in the developed world.

“The latest figures are the nail in the coffin for Australia’s economic freedom.”

In 2022-2023, personal income taxes generated $278.4 billion for the federal government, accounting for 45 percent of the $618.2 billion in revenue.

“As usual, it is working and middle class Australians who are being forced to do all the economic heavy lifting,” Wild said.

“It is these Australians who are now being inundated with ever-increasing taxes that they simply cannot afford.”