Homeowners with a mortgage may have felt a looming sense of dread over the past two years.

Since interest rates started rising, many of Britain’s nine million mortgage households and almost two million homeowners have faced the prospect of much higher payments.

Before this, many had been accustomed to ultra-low interest rates for more than a decade.

With each passing month, another 150,000 borrowers reach the end of their low fixed interest rates – and many find themselves moving to mortgage rates two, three or even four times higher.

Locked up: Homeowners typically spend the majority of their income on their mortgage

For households, this will typically account for the majority of their total monthly expenditure.

But while people with mortgages have a right to feel aggrieved, how many of them are on the brink of financial ruin, or heading that way? Some are calling it a “mortgage crisis,” but is that really true?

In this six-part series we look at how much more people actually pay when they take out a new mortgage, how households deal with this and whether a mortgage crisis is on the way.

Firstly, we look at how much more people are paying for new mortgages compared to the cheaper deal that many are taking out.

How much more do we pay for mortgages?

Last week, the Office for Budget Responsibility (OBR) predicted that average mortgage rates for all households will peak at 4.2 percent in 2027.

This is an increase from a low of 2 percent at the end of 2021 and above the average mortgage rate in the 2010s of around 3 percent.

The OBR average rate includes all fixed and variable mortgage rates that households currently pay.

This also applies to those who stay on very low fixed rates. Therefore, OBR rates are generally lower than the market average for new home loans.

The market average rate, as reported by Moneyfacts, takes into account every fixed rate deal currently available to those buying or remortgaging.

The average two-year fixed rate mortgage deal is currently 5.78 percent, while the average five-year mortgage deal is 5.35 percent, according to Moneyfacts.

That’s significantly more than the average two-year, five-year fixed-rate mortgage deals paid before rates went up in 2022.

For example, according to Moneyfacts, someone who took out a mortgage in March 2022 now gets away with an average rate of 2.64 percent.

For a mortgage of €200,000 that is repaid in 25 years, this is the difference between €911 per month and €1,262 per month with a two-year fixation.

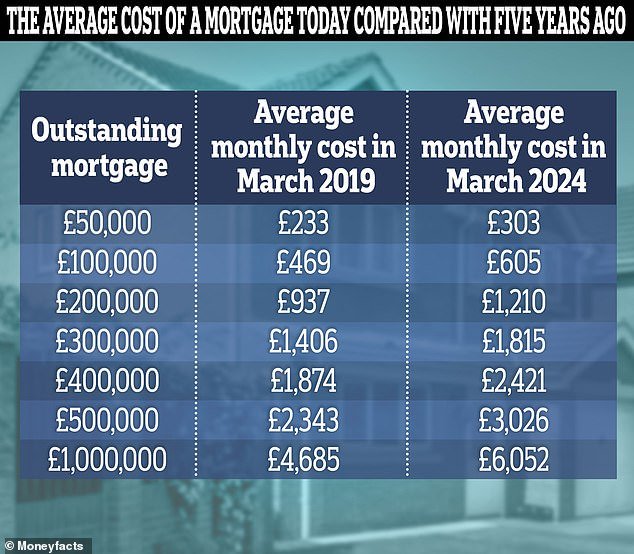

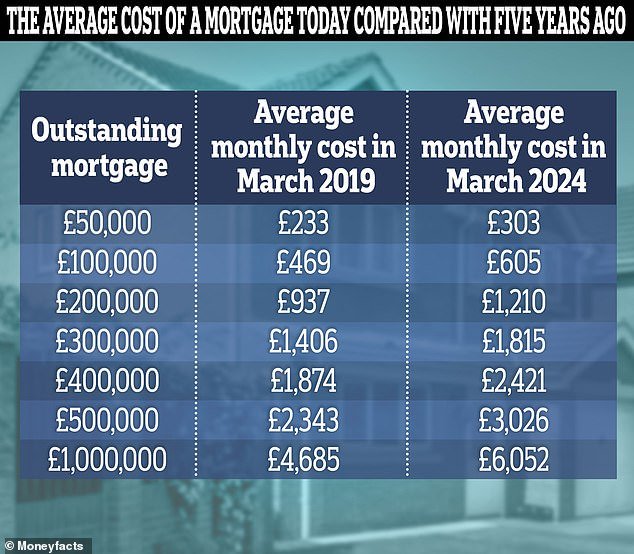

Based on the average cost of a five-year fixed rate mortgage, according to Moneyfacts data

Meanwhile, a five-year fix taken out in March 2019 would have an average rate of 2.89 percent.

For someone with a £200,000 mortgage paid off over 25 years, that’s the difference between paying £937 a month and £1,210 a month.

Many people get a cheaper rate than the average, especially if they have more equity in their home and a good credit profile.

But even those with the largest deposits or the largest amount of equity will see their costs rise. Exactly five years ago, the cheapest five-year solution was 1.79 percent. Now it is 4.09 percent.

For someone with a mortgage of €200,000 that will be repaid over 25 years, that is the difference between €827 and €1,066 per month.

If someone moves from the cheapest two-year fix in March 2022, which was 1.64 percent, and now moves to the cheapest two-year fix at 4.6 percent, the jump will be even bigger.

For a mortgage of €200,000 that is repaid in 25 years, this is the difference between €813 per month and €1,123 per month.

Arjan Verbeek, CEO of mortgage provider Perenna, said: ‘For those who refinance, they will experience a significant increase in their monthly repayments, which is typically the largest fixed cost most people incur.

“Some may be able to weather this surge, but at what cost?

‘The costs of cutting consumption elsewhere and being forced to make compromises – whether that’s postponing major life events like getting married or starting a family, not being able to take a well-deserved holiday, or instead being forced to to go into their pension savings.’

For now, however, many mortgage holders remain protected from higher interest rates by their fixed-term agreements.

David Hollingworth, associate director at L&C Mortgages, said: ‘There is an element of timing, meaning the crisis level will depend heavily on when the last deal was done and for how long.

‘Many are far from entering a crisis, having witnessed the worst of the mortgage rate spike from the comfort of a persistently low fixed rate.

“For those homeowners who have moved to higher rates, they will scale back their spending accordingly and scale back their spending to prioritize their mortgage payments.

‘No one will easily find an extra few hundred pounds a month, so this is certainly a challenge for borrowers.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.